Larix Monthly Report [Nov]2021

Overview

Larix has made consistent progress the last month that involves partnerships, branching out the staking use cases for LARIX, and some product updates which are nearing completion. Let’s take a look at the progress Larix has made since our last monthly report.

Product Progress

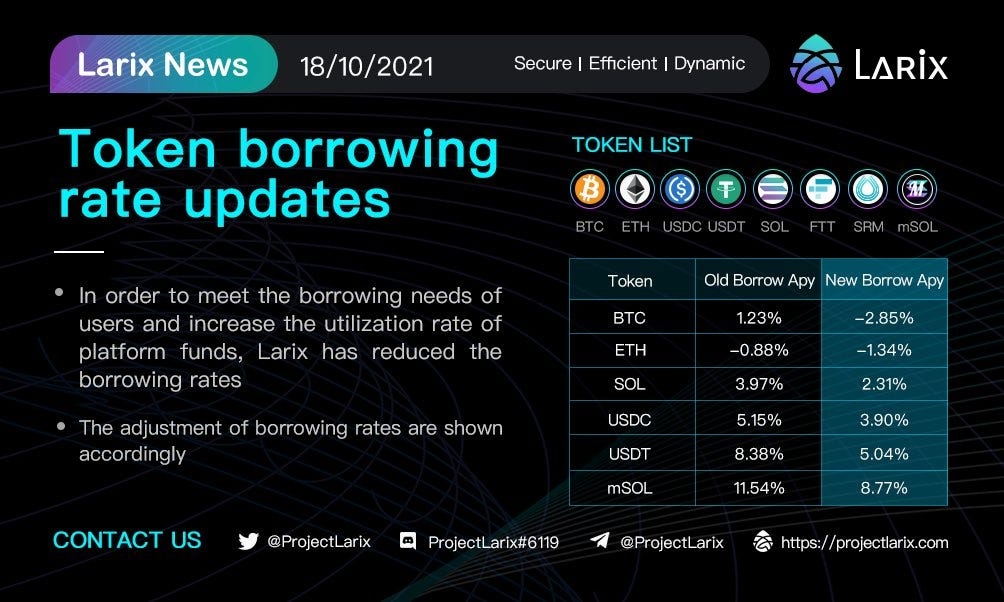

At Larix, we are constantly updating our interest rates to correspond to utilization rates within the isolated asset pools that are in line with DeFi industry standards.

Larix has added another Solana Gem, Raydium’s native token, to its arsenal of supported assets. The Isolated asset pool for Ray saw huge demand for collateralized borrowing activity due to IDOs on the Raydium protocol the last two weeks. As such, the interest rates for Ray got bumped up to almost 100%, so it is very nice to see the dynamic interest rate model in action. This makes us hugely optimistic for the future of DeFi and the tokenized economy the world is transitioning into.

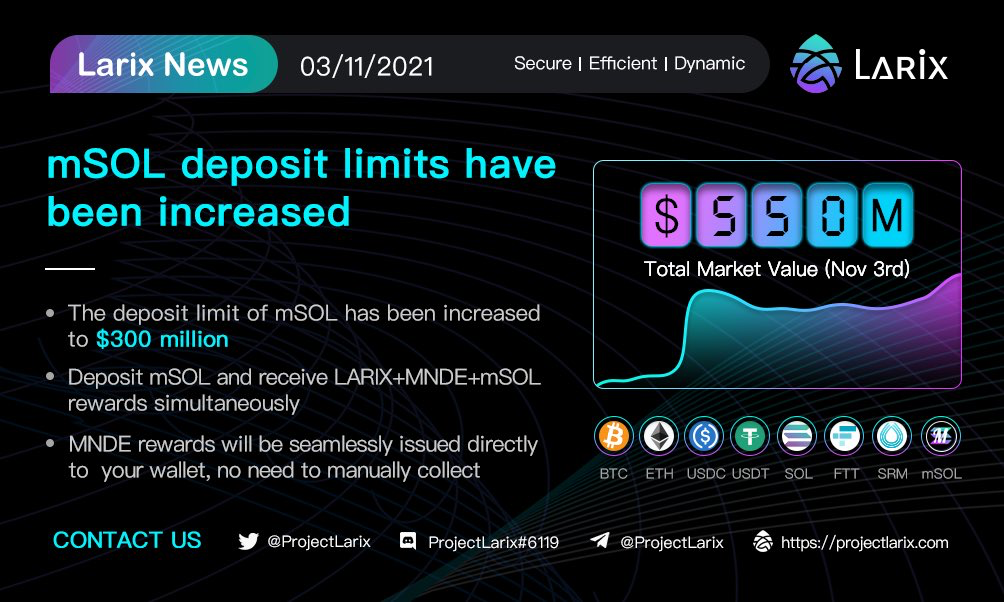

A few rounds of accelerated mining was held with mSOL and SOL, respectively. In the former’s case, users effectively earn tripple rewards in $mSOL+ $LARIX+ $MNDE. Since the launch of mSOL, it has continuously maintained dominance as the preferred asset to supply by users. We expect this trend to continue as Marinade maintains the position of the best liquid staking protocol for Solana.

At Larix, we take security as our primary core focus and let the innovation evolve around it. Our business model dictates that we build, test, set limits, and finally remove those limits once our smart contract delivers optimum frictionless results. mSOL continues to be our most popular asset, due to the combined innovation of liquid staking from Marinade and triple rewards on mSOL supplied to the asset pool.

As set forth by our roadmap, product updates and new features are in the pipeline and the next one is in sight. Larix is proud to announce that we will launch LP mortgage lending with a compounding functionality very soon and we urge users to stay tuned.

Milestones

In DeFi, borrowing value will always lag behind that of supply, and at Larix we are happy to see growth in total borrowed value as users are becoming more comfortable with security, volatility, and our over-collateralized lending model. As such, the total borrow value at Larix reached $100k.

On to the comparative data and some stats. Larix continues to keep up with the pace within the overall Solana ecosystem as our forged integrations with partners are seamlessly all growing together. On November 1st, Larix was dubbed the leading lending protocol on Solana, the fastest-growing public chain. As such, on November 3rd, Larix’s TVL reached an ATH of $650M.

Operational Progress

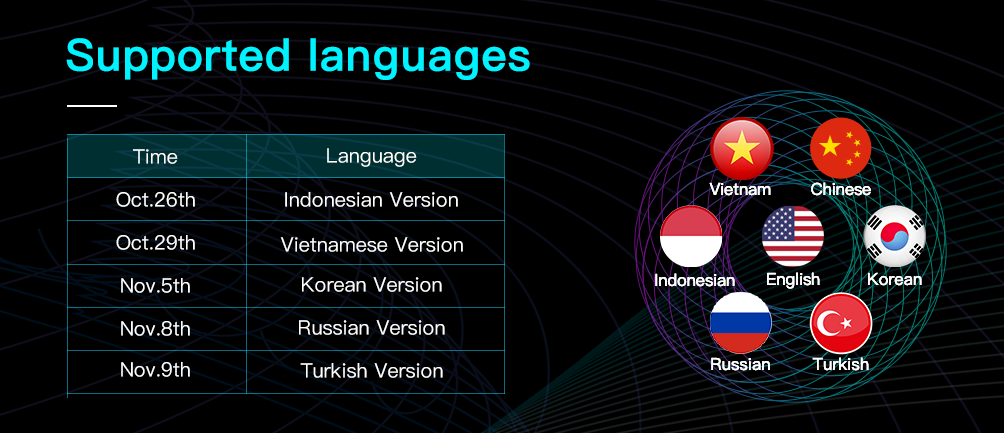

Larix has utilized efforts to penetrate different jurisdictions along with supporting different versions of the platform in five different languages, such as Indonesian, Vietnamese, Korean, Russian, and Turkish.

Events

On Nov, 5th, Larix launched the Golden Mining Week event. With the APY of all tokens increased 2–3 times, and interest on borrowing on all tokens reduced by 30%-60%.

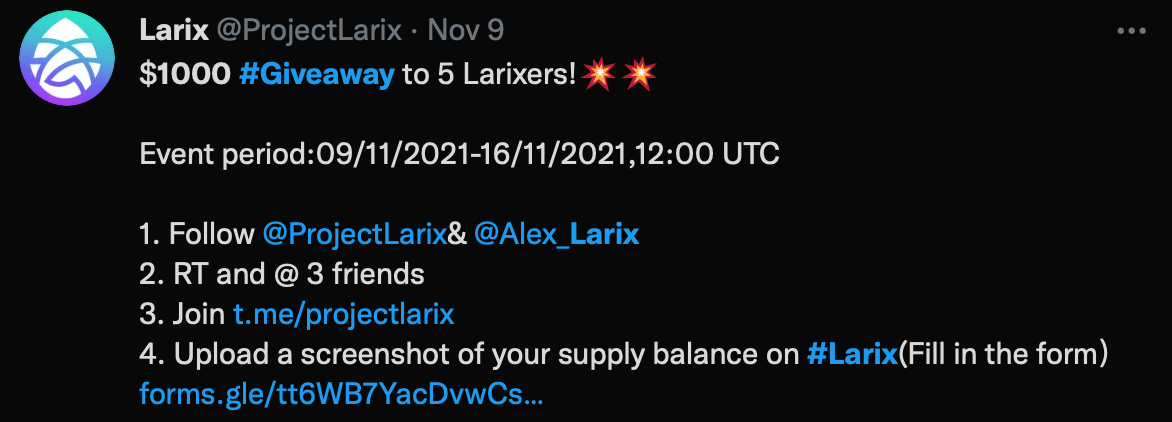

On Nov 9th, Larix announced a $1000 giveaway to 5 Larixers.

On Nov 11th, Larix announced an exclusive trading event on MEXC with limited NFT rewards.

On Nov 25th, Larix launched the ‘2021 Thanksgiving’ staking event with Slope, with a prize pool of 200,000 $Larix and $1,000 of USDC. This, subsequently, resulted in 4,000,000 LARIX tokens being locked in the staking process.

Marketing Progress

On Oct 19th, Larix was incorporated into APY.TOP’s aggregation search functionality.

Larix is proud to have established a partnership with Orca, one of the leading and most user-friendly DEX within the Solana ecosystem. The partnership allowed users to simultaneously earn LARIX and ORCA rewards by adding LARIX/USDC LP on ORCA. Orca had a huge influence in boosting the aggregate TVL of LARIX outside the protocol, which led to an increase to $10 million, jointly contributed by Raydium, Orca, and Tulip.

One of the new leveraged trading DEXs, WOWswap, added support for LARIX where users are able to trade up to 3x on their positions. We always enjoy witnessing the innocavation projects’ bring to the Solana ecosystem.

One of the absolute Gems in the Solana ecosystem, Symmetry, bringing portfolio management tools and idexes to crypto, and a very exciting partner of Larix, has added support for LARIX on their instant swap. We are extremely excited for our next move in conjunction with Symmetry, so keep an eye out.

SolanaSail is a famous community on Solana, SolanaSail will continue to report on the recent progress of Larix.

Another month, another three wallet integrations where users can access the Larix protocol directly from within the wallet UI. Added to the list was the multichain user-friendly wallets of Bitkeep, Coinhub, and Tokenpocket in addition to C98, Slope, Math Wallet, Solong, and Solflare. We are very excited to observe the crypto wallet infrastructure grow over the months and years to come and we believe this will be one of the catalysts that will contribute to onboarding the next billion users into the new world of Decentralized Finance.

On 18th Nov, an article was published about Larix on Yahoo Finance.

Atrix, one of the newest DEX protocols with an outstanding feel from a user perspective and who absolutely smashed it with the UI, has partnered with Larix to give users another portal for instant swap functionality in addition to LARIX/USDC liquidity mining with rewards that stretched up to 150%.

That is not where the partnership integrations have ended. LIQ Protocol is an official liquidator on Larix and thereby offering maximum efficiency and timeliness when it comes to borrowing activity within the isolated asset pools.

Cropper Finance is the Ultimate Yield Farming Platform on Solana. The two projects will work together to integrate themselves into the Solana ecosystem, even more, LARIX/UDSC pair will also launch on Cropper.Finance.

AMA

Larix held multiple AMAs with a number of different partners communities. Namely; Math Wallet, ORCA, Slope, Bitkeep, BlockSolFi, Atrix, and Coinhub.

Last but not least: Larix2.0 (Metaverse Finance) is coming!

In the next 2 months, we have more exciting progress:

● Larix2.0: We use a new slogan, which marks that Larix has entered the Larix2.0 stage, and Larix will focus on a wider range of meta-universe financial services in the future. This is a new beginning!

● LP mortgage lending: We will be the first platform on Solana to support Raydium’s LP mortgage lending platform. Which LPs do you want to be supported first? Express your thoughts in the community.

● Leveraged lending: We will continue to support the leveraged transactions of Raydium and ORCA. Which LPs do you want to be supported first?

● NFT: Our NFT is undergoing design currently, stay tuned for Larix NFTs. Larix will also continue to empower $LARIX through NFT functionality.

● Meta Universe Fund: Larix will prepare a $20 million Meta Universe Ecological Support Fund, and more details will be announced in the Larix official community.

● Repurchase and burning plan: Repurchase and burning have been included in the Larix plan. Please stay tuned for the specific ratio and methodology (such as automatic execution via smart contract), and welcome to participate in the discussion in the community.

● Protocol controlled liquidity: Larix will upgrade to Liquidity Mining 2.0, which will be exciting news for Larix deposit users and liquidity providers.

● Multiple mining rewards: more partners will join us and open multiple reward activities

Last updated