Roadmap

Larix is the ultimate lending gateway on Solana. All valuable assets, including crypto tokens, stablecoins, synthetic assets, NFTs, and asset-backed securities (account receivables, invoices, mortgages, etc.) are soon accepted as collaterals to borrow crypto assets, generate yield, and power the real economy.

Phase 1: Jun — Sep 2021

Larix begins by meeting the essential needs of automated cryptocurrency-lending on Solana. At this stage, crypto tokens, stablecoins, and synthetic assets are used as collaterals.

In response to multiple flash-loan attacks and malicious market manipulations, the collaterals will be carefully selected and parked in several isolated pools as clusters according to the underlying asset risk profiles. This is a more optimal way to control and mitigate platform risk and protect both borrowers and lenders. We all know that a larger liquidity pool accommodates smaller slippage. The collaterals are rated and grouped by their market capacity, concentration risk, volatility, etc. As such, assets with distinct risk measurements could be managed separately to enhance risk management capability and reduce potential loss at the protocol level.

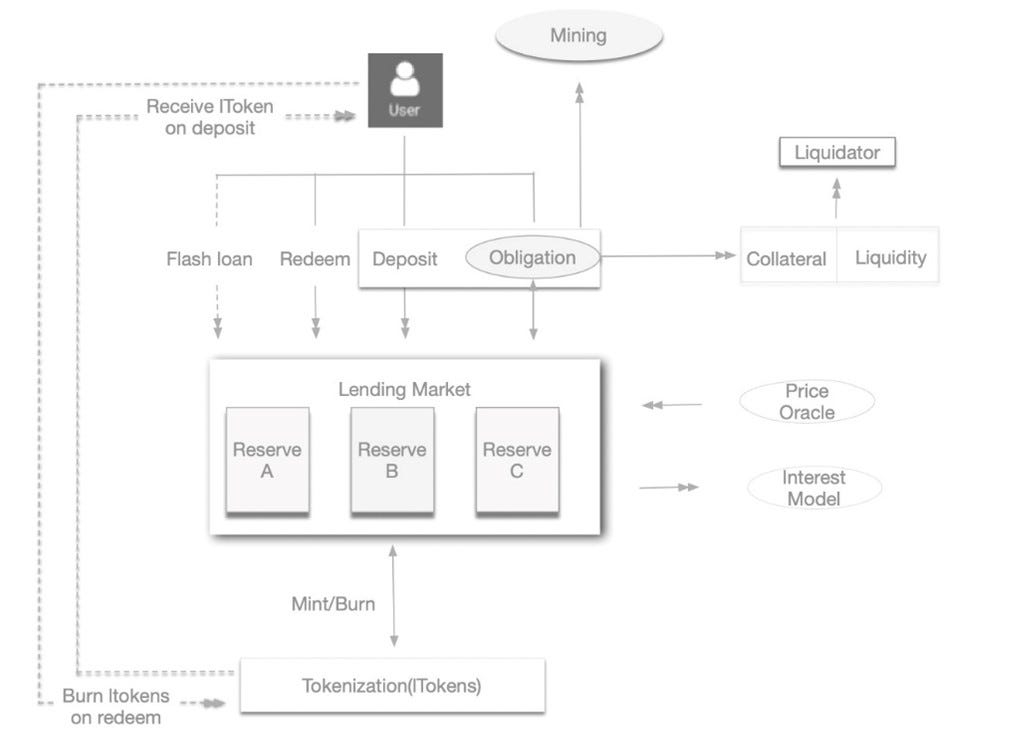

Larix adopts a dynamic interest rate model to manage liquidity and avoid a “Bank Run” when depositors need to withdraw from the pool. Liquidity pools across different tokens are an essential part of Larix. The carefully designed interest rate model is manages to incentivize both borrowers and lenders by rewarding them with Larix tokens, the native platform token. A Decentralized Autonomous Organizations (DAO) will be introduced to Larix through voting and governance tokens. Critical matters, such as changing mortgage factors, adding/removing collateral tokens, and special acceleration in certain mining pools, could be decided through DAO proposal voting.

Phase 2: Late 2021 to 2022

Partnering with PYTH network to connect high-fidelity (HiFi) financial markets to the world of decentralized finance (Defi), which enables higher capital utilization of a wider range of conventional financial assets. In addition, term-loan and Initial Lending Offering (ILO) facilitate projects in the Solana ecosystem to capitalize themselves through token-backed debt financing.

Phase 3: 2022 onwards

The protocol extends the collateral base to accept non-fungible tokens (NFTs) and enable peer-to-peer lending across all asset classes. In general, all valuable assets in our digital wallets should find their places and value propositions as collateral to release liquidity. NFTs started to gain popularity in 2021 supported by celebrities, such as Linkin Park’s Mike Shinoda and the Weeknd’s genesis nifty collection. Increasingly more creators are joining the NFT hype train. CoinGecko pointed out that “despite its slow start, Google searches for ‘NFT’ far outstrips ‘Defi’ by March 2021.”

According to the exchange's data, even sports-related NFTs, such as the NBA's Top Shots, captured a nearly $28 billion market cap and still growing. Users who intend to supply liquidity and generate passive income with their NFT assets puts NFT-backed-lending on our roadmap.

Finally, tokenized ABS and wrapped NFTs, which serve as a bridge from real-world assets to the digital arena, will find their time to shine. For example, accounts receivable factoring, invoicing, mortgages, and student loans are all seeking more flexible financing options from the digital capital market. DeFi lending is the perfect vehicle to provide secure, customizable, and almost instant liquidity. Larix is working with multiple partners in this space to power the real economy.

Last updated