Larix Monthly Report [Oct]2021

Overview

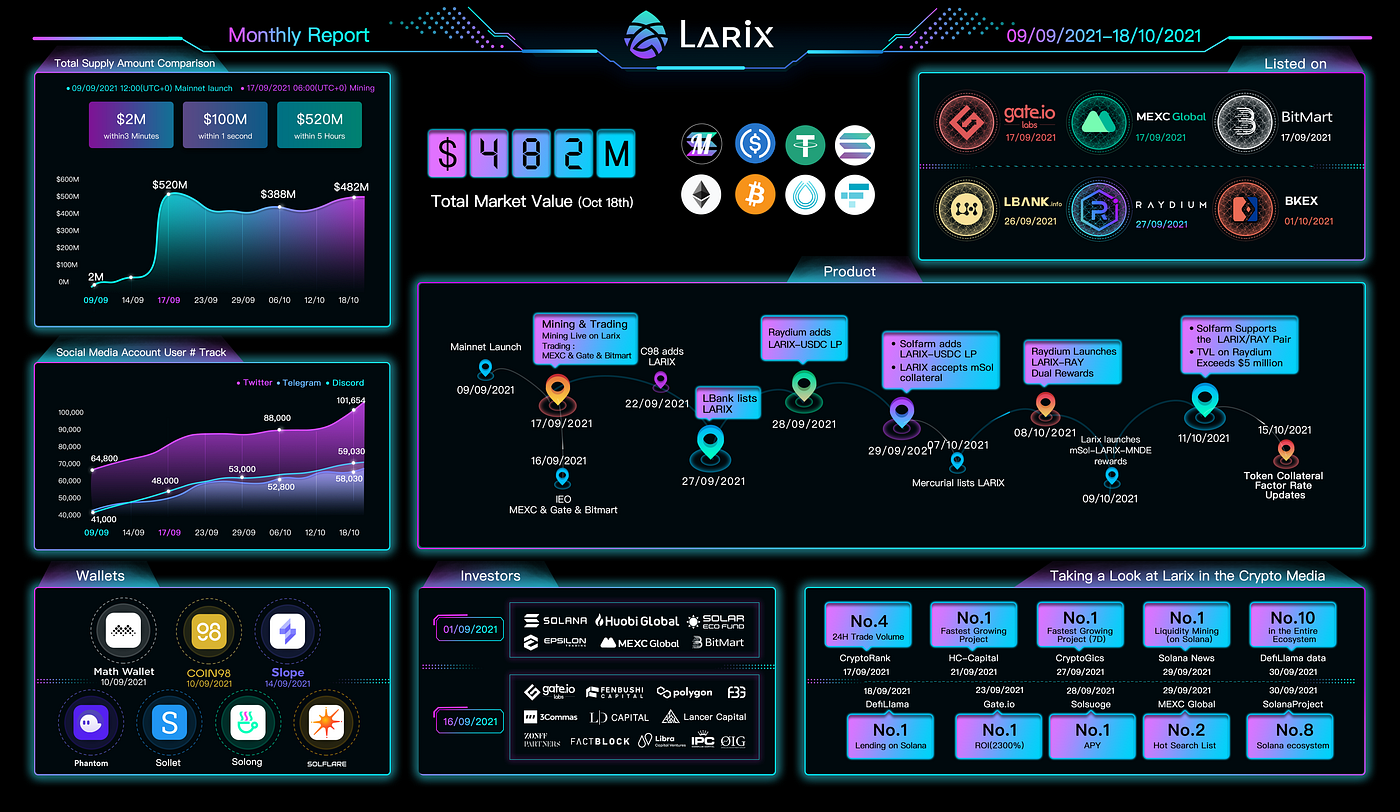

Investment

The seed and private round investments were closed in mid-Sept with support from Solana Capital, SolarEcoFund, Epsilon, Huobi Venture, Gate.io, MEXC, BitMart, Fenbushi, Polygon, FBG, 3Commas, LD Captial, Lancer Captial, Zonff Partners, FACT Block, Libra Capital, IconPlus Capital, OIG Capital, and IPC.

Production:

1. Larix mining started on 17 Sept. 5 hours after launching, TVL from both borrow and lending exceeded $520 million, which was the largest lending platform on Solana.

2. On 18 Sept, the liquidation function went live as well, which enabled all users to participate in liquidation events.

3. On 29 Sept, Larix added mSOL as the latest collateral asset.

4. On 15 October, Larix updated the collateral factor of some tokens to further increase the utilization rate of user funds. The update was as follows:

BTC : 0.75 >> 0.8 ETH : 0.75 >> 0.8 USDT : 0.75 >> 0.85 USDC : 0.75 >> 0.85 SOL : 0.75 >> 0.8

5. On 16 October , Larix continued to increase the deposit limit of mSOL to $200 million. That resulted in Larix becoming mSOL’s largest single token pledge platform.

Marketing:

1. On 10 Sept, Larix announced a strategic partnership with MathWallet.

2. On 10 Sept, Larix formed a strategic partnership with Coin98.

3. On 14 Sept, we finalized a strategic collaboration with Slope.

4. On 16 Sept, Larix launched IEOs successfully on 3 exchanges simultaneously — Gate.io, MEXC, and BitMart. Users on Gate.io experienced over 300X oversubscription rates and MEXC received IEO qualification bidding from more than 12k participants. IEO quota allocated to BitMart was snapped within merely one sec.

5. On 16 Sept, Larix held the first AMA with the OIG Community. There are a few more AMAs conducted among Solana communities with joint marketing efforts with various platforms.

6. Here are some media coverage in Larix’s birth month:

(1)CryptoRank suggested that Larix is a top ticker by daily trading vol

(2) On 18 Sept, DefiLIama showed that Larix was the largest lending platform on Solana, and it was ranked as the 15th largest lending protocol globally across all ecosystems.

(3) According to data from HC-Capital, on 21 Sept, Larix was the fastest-growing project in terms of TVL in the entire network.

(4) On 23 Sept, Gate.io captured LARIX as the project with the highest ROI (return on investment) on its platform.

(5) According to CryptoGics data, on 27 Sept, Larix was the fastest-growing project in TVL in the last 7 days on the entire network.

(6) SolanaProject suggested that Larix is ranked 8th place in the Solana ecosystem by TVL as 30 Sept, which is only 2 weeks after official launch.

(7) On 29 Sept, SolanaNews verified that Larix’s liquidity mining revenue was ranked №1 in Solana’s ecosystem.

(8) DefiLlama revealed that Larix was №1 lending protocol, and ranked as top 10 protocols in Solana shortly after launch.

(9) On 27 Sept, Larix launched LARIX/USDC liquidity mining on Raydium. It was the first lending platform to launch a fusion pool with Raydium with a lock-up value of up to $4M.

(10) On 29 Sept, SolFarm introduced the LARIX/USDC pair liquidity mining and supported re-investment with APY up to 2,000%.

(11) On 29 Sept and a few days this month, LARIX was ranked top 3 on the MEXC hot search list a number of times.

7. On 11 October, Solfarm supported the LARIX/RAY pair

8. On 11 October, the liquidity of LARIX on Raydium exceeded $5 million

9. On 12 October, Vote for Larix to win iPhone 13 Pro MAX + iWATCH + iPad mini

Operational Progress :

1. On-line public beta bounty test took place on the 14 Sept

2. The joint marketing event with MEXC was launched on the 15 Sept

3. Gate.io started a joint publicity campaign on 16 Sept.

4. On 16 Sept, Larix joined CMC to activate a mining promotion event.

5. On 15 Sept, the community published the LARIX token empowerment ecological map through discussion on Discord and Telegram.

6. The LARIX token was supported on the Coin98 wallet on 22 Sept.

7. On 26 Sept, Sonar supported the depository and borrow function of Larix.

8. On 28 Sept, IPC released a promotional video of Larix.

9. Larix is clearly ahead of other competitors in terms of APY, TVL, and liquidity for large-cap tokens such as USDC, ETH, BTC, SOL, and USDT.

Community Build-up:

1. Larix’s community continued to grow rapidly and was far ahead of its competitors. In Sept, Twitter followers exceeded 101K. The Telegram group added 15K+ users to a total of 55K. Discord channels reached 60K, and Medium attracted 1.1K+ followers. Larix has established many local communities in various countries/langugaes globally.

Last updated